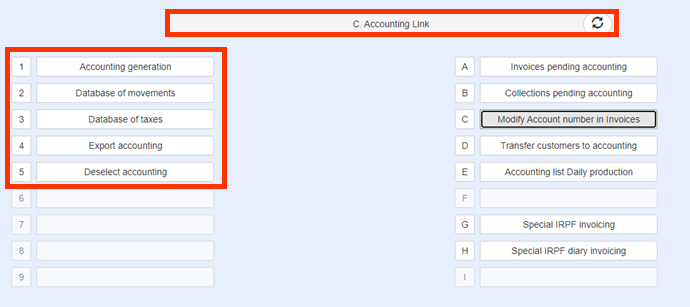

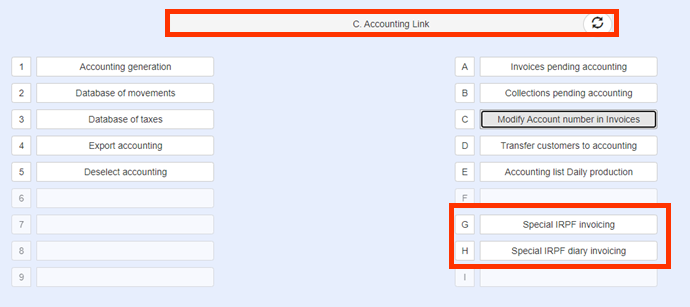

First Step

Second Step.

Third Step.

Pass the section C.4. Export to Accounting. It will be said between the dates that you want to export

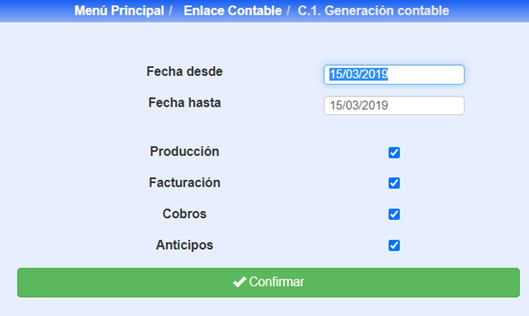

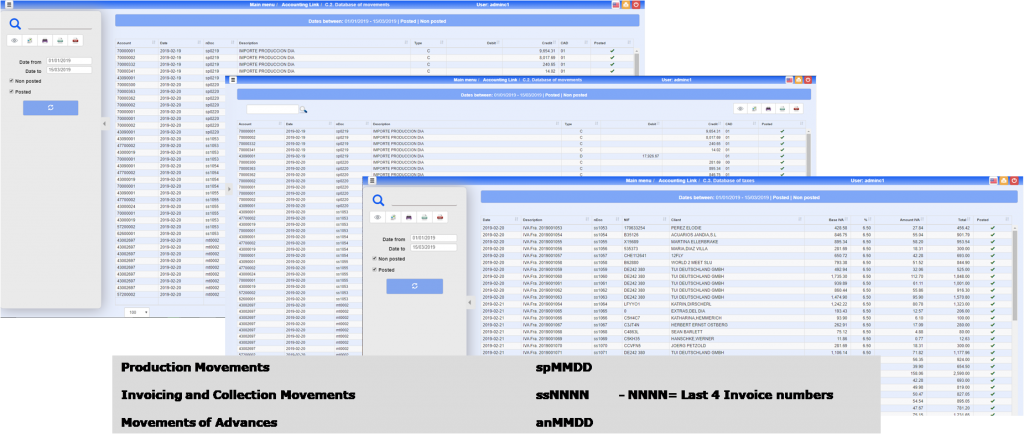

C.1. ACCOUNTING GENERATION

- This process can take a long time, especially if you do long periods (monthly, weekly, fortnightly,…), since you must check all the movements.

- It is advisable to spend the four processes always together, although in case of need it can be done separately. Production, Invoicing, Collections and Advances

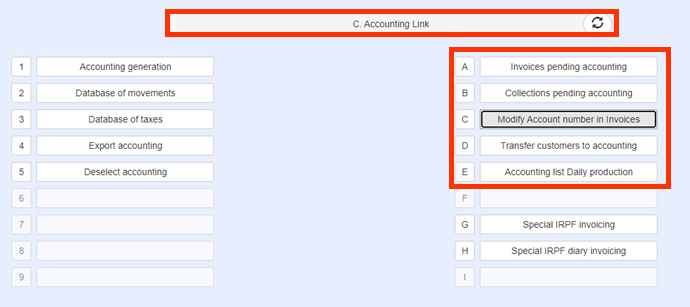

Accounting links. Procedure .C.2/3.

Verification of the movements of Notes and VAT generated, both from the previous process and from other processes. By default we will see only the movements NOT ACCOUNTED, but you can also see all those movements that have been previously accounted for.

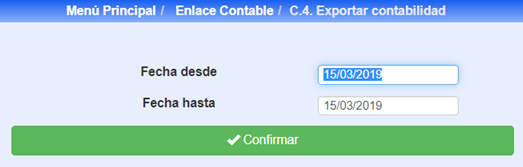

Accounting links. Process C.4. Export to Accounting.

We will indicate him from date until which date we want to export

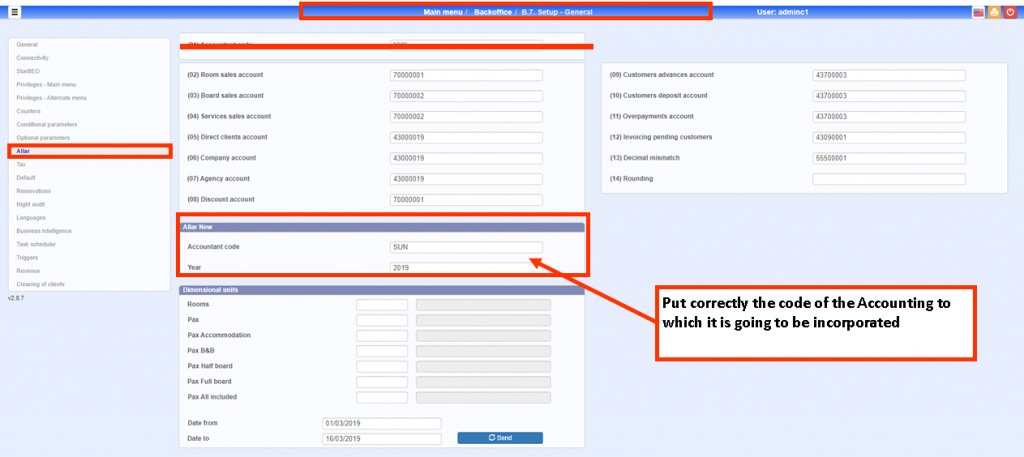

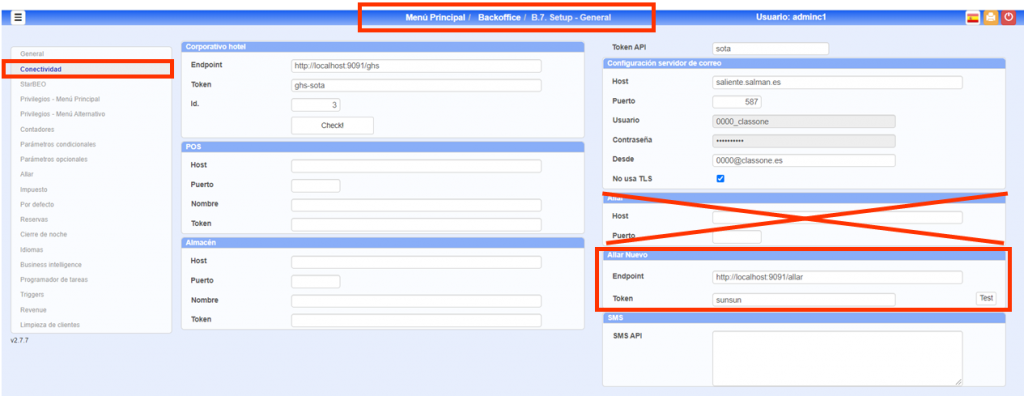

Accounting links. Accounting parameters

The parameters for the link with Accounting must be perfectly defined, otherwise there would be an error and the export would not take place.

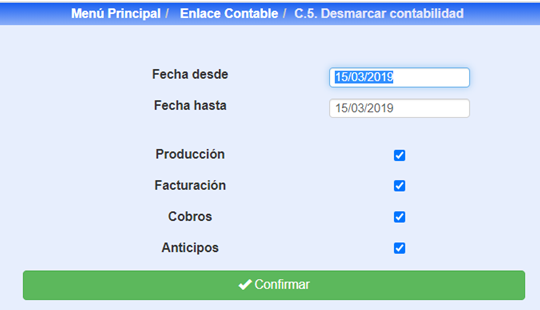

Accounting links. C.5. Deselect Accounting

Back to Start

Through this process we can remake the previous steps again

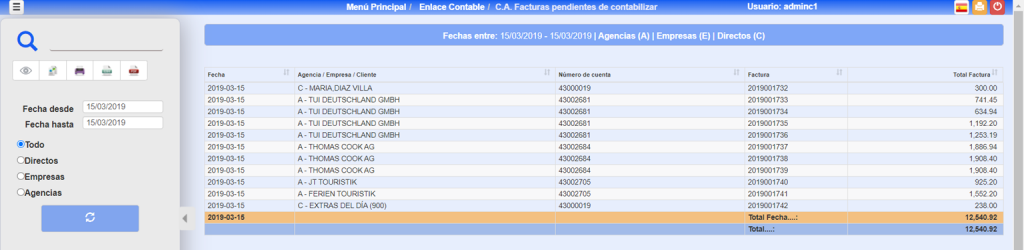

C.A. Invoices PENDING Accounting

As the accounting link can be made so that invoices and collections are chosen between two dates, it is possible that we do not remember at any given time which invoices are pending to link accounting. This is precisely the objective of this option.

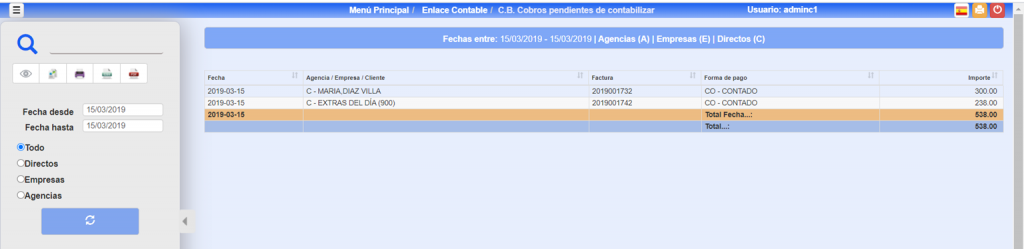

C.B. Collections PENDING Accounting

As the accounting link can be made so that invoices and collections are chosen between two dates, it is possible that we do not remember at any given time which COLLECTIONS are pending to link accounting. This is precisely the objective of this option.

The list will show the partial total of the day and the global total of the selected dates.

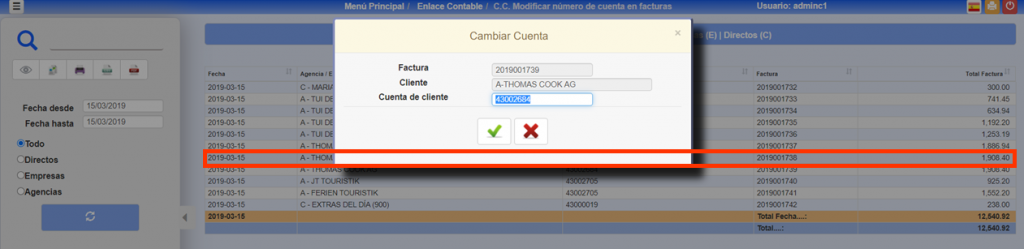

C.C. Modify Account Number in Invoices

Normally a Hotel has defined a strategy regarding the accounts to be assigned to each new customer. These accounts are taken for the invoice file so that they will go to accounting with the link

In this option the pending invoices of accounting link are shown, and we are allowed to modify the accounts of clients if some had assigned an incorrect account.

We will be able to filter the list by Agencies, Companies, Clients or All.

To modify the account number, simply click on the corresponding register and type m or double-click on it. Click on

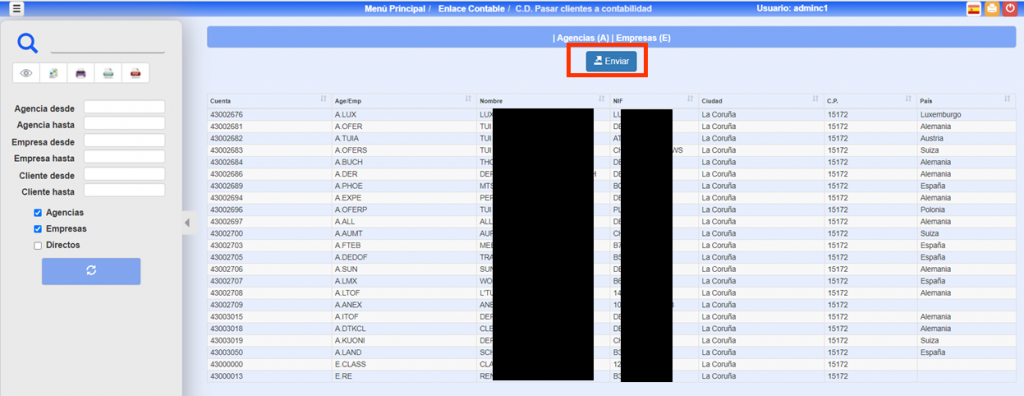

C.D. Pass clients to accounting

With this option we will transfer your data from our Cardex (Agencies, Companies and / or Clients) to our accounting. There are hotels that create accounts in Reception with the data of Clients, Agencies and / or Companies and in this way it is not necessary to do double work.

It consists of two parts, a first one that selects the elements to pass and once we see them on the screen and consider that it is correct, pressing send they are “migrated” to the Accounting.

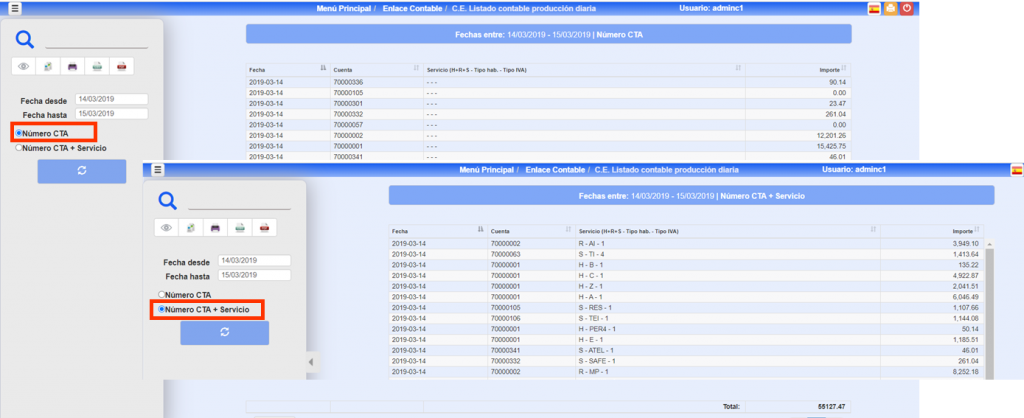

C.E. Accounting List Daily Production

It anticipates or confirms us as they were the seats of the Daily Production, between the dates that we determine him.

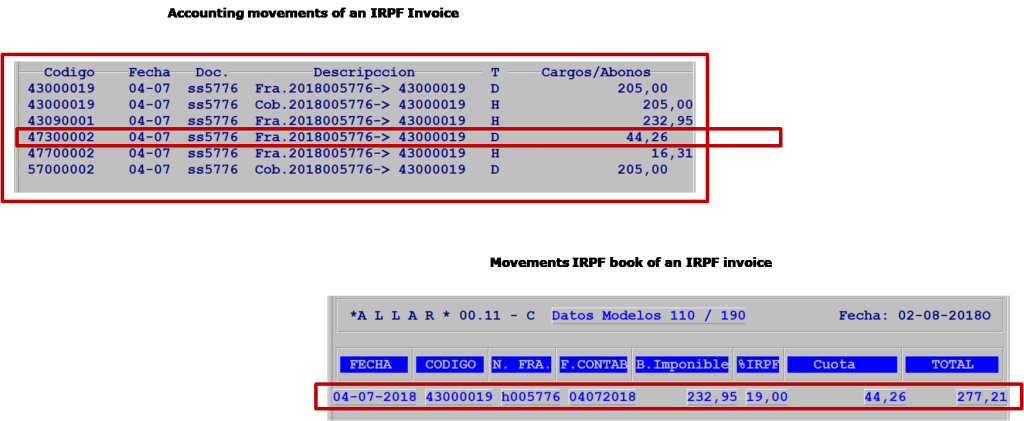

C.G/H. Special IRPF Invoicing

There are Hotels that rent LOCALS, therefore this INVOICE must take a concept that is the I.R.P.F., by means of this option it is possible to carry out these invoices.

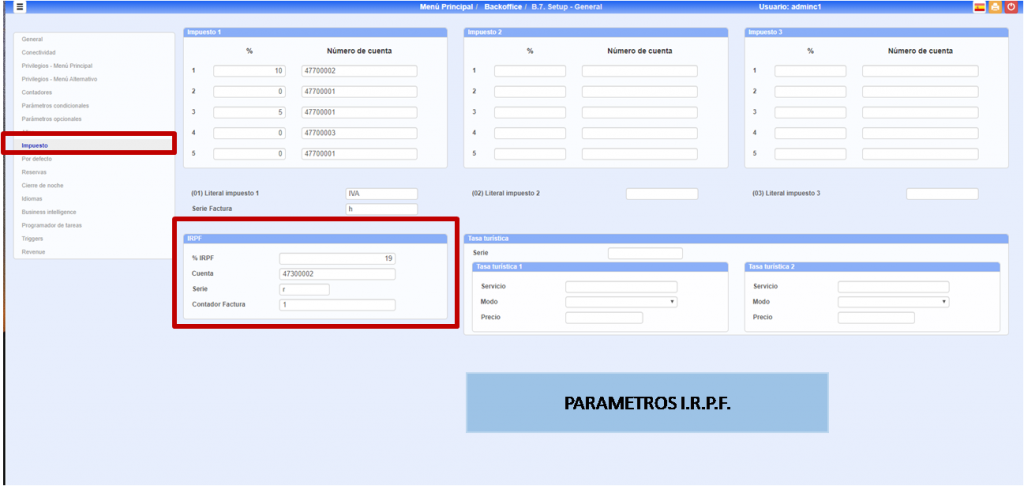

In the first place you must give the data so that the accounting chain and the calculation of the IRPF (currently of 19%) is carried out correctly, go to Backoffice, Setup-General.

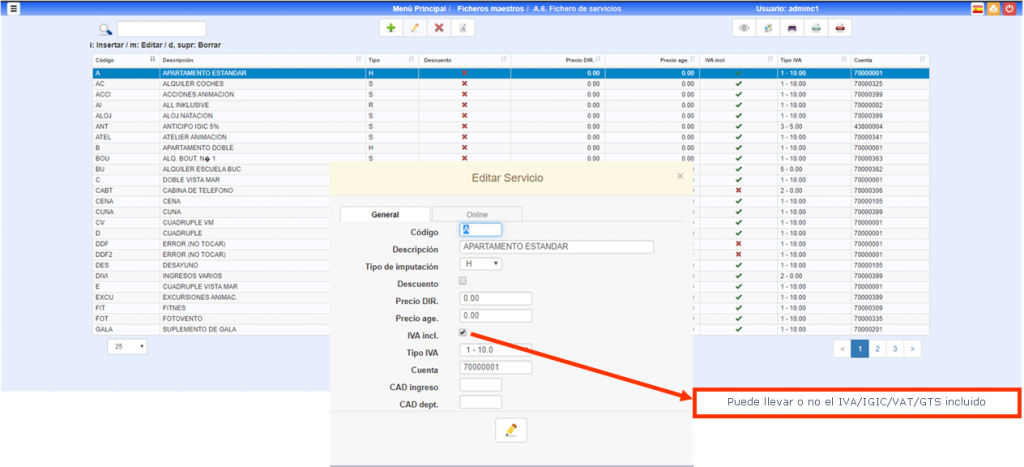

You must also have a SERVICE created for this purpose. (Option .A.6.).

The next step is the SPECIAL IRPF INVOICE. (.D.G.).

The following values must exist in the Setup. IRPF %, IRPF Accounting Account, Series and Invoice Counter

May or may not carry VAT/IGIC/VAT/GTS included

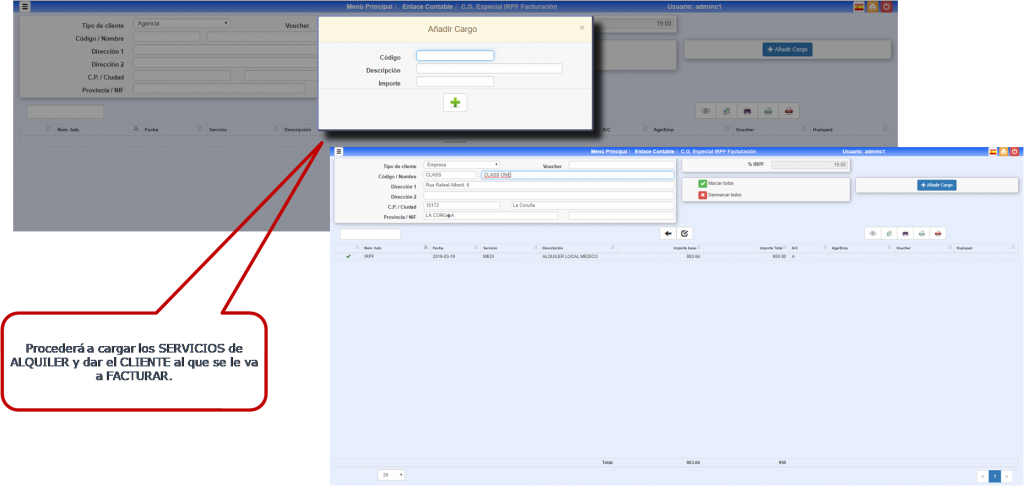

Proceed to load the RENTAL SERVICES and give the CUSTOMER the INVOICE.

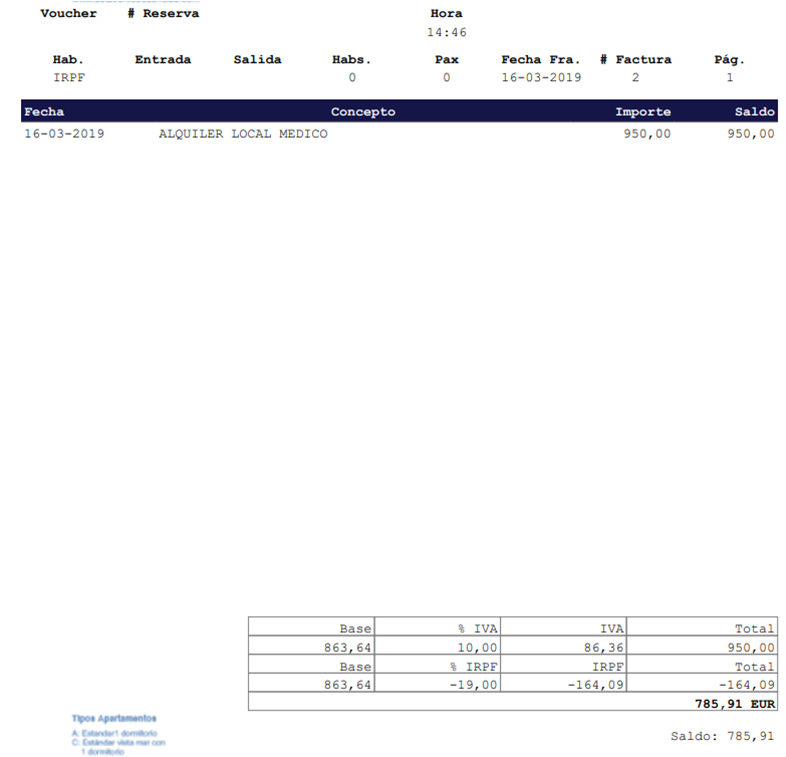

We would get an INVOICE similar to THIS depending on the type of INVOICE you have.

As you can see, it goes into the same INVOICING process as the rest of the HOTEL.

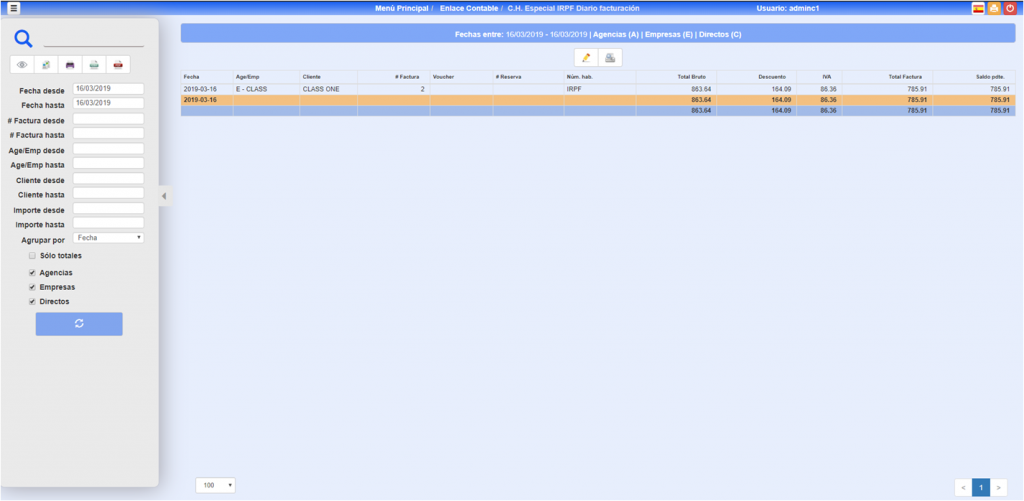

Special IRPF Diary Invoicing (Otpion .D.H.)

We will get those invoices that are IRPF