VAT – Difference in Totals of Base Invoice percentage and VAT quota

Client

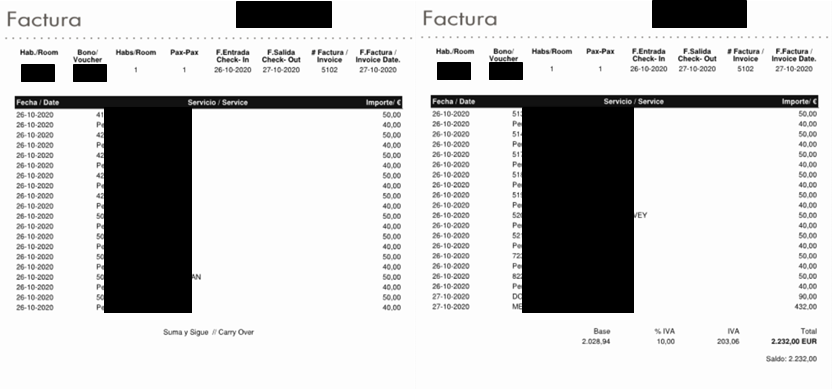

I am passing you an invoice as a sample of the issue of the VAT breakdown, which is not correct, we really hadn’t noticed it and there are probably several more (for example 5586), a client told it us

The breakdown of VAT does not correspond to the amount of the tax base

Answer

It happens: VAT is rounded off line by line so that the sum of the parts is not equal to the sum of the totals. At the same time, line by line, the production is stored which must be to two decimal places. This “conflict” can be displayed when the invoices are very large, and also when the calculation of the VAT of a line gives a periodic value, since a rounding will have to be done.

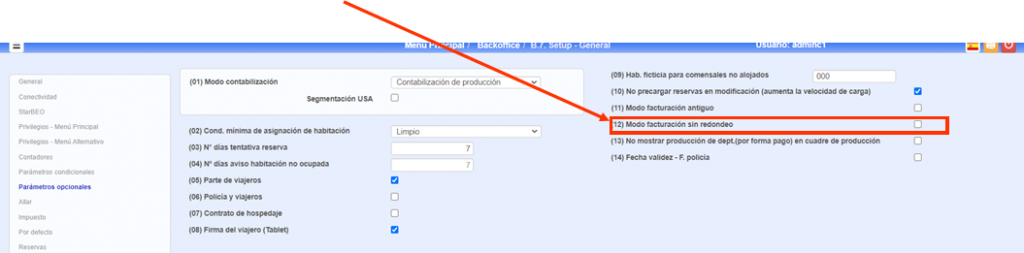

This is not a solution, but rather another way of treating the data, but it has repercussions. In the option B.7 General Setup, in “Optional parameters”, there is an option called “(12) Billing mode without rounding”, when not rounding line by line you will see that the totals coincide but this means that the billing will be different from the production, in accounting terms (and in our accounting program you can take this into account) there would be a rounding account, where this difference would go. IMPORTANT: If you activate this option, it must be first thing in the morning, before generating the first invoice, so that it does not generate conflicts with the following accounting link. Remember that this parameter is not retroactive, when it is changed it will not affect previous invoices, only those created from the moment of the change.

Our recommendation is to continue as before, so that invoicing coincides with production.

Reasoning

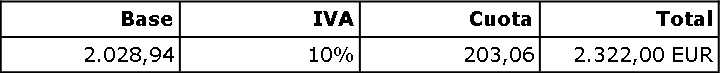

- 2.028,94 + 203,06 = 2.322,00 EUR

- 2.028,94 x 10% = 202,89 //

- 50 = 45,45454545454545 + 4,54545454545455

- It is clear that the sum of partial numbers (rounded off to 2 decimal places) is not equal to the sum of the totals

- Therefore, two criteria can be applied

- The one we apply in this case: The Bases are those that correspond in Production, the total is the one that corresponds to the sum with the included VAT and in the VAT the difference is applied so that it fits perfectly.

- Make the calculations differentiating Production (it would not fit with the invoice), and adjust in the Total according to the VAT, which is what is explained in the solution. Thus the invoice would be perfectly, but neither the Production nor the Production Accounting would have a deviation with respect to the Invoicing Accounting.