Non-Refundable Treatment

When a Client accepts the payment of a non-refundable rate, the immediate meaning for the Hotel is its collection on the spot. A similar philosophy could also be applied to the advance payment of Reservations days before the client arrives (rules described in the Reservation). Spanish legislation requires that if it is an amount greater than € 300, an invoice must always be made for it, that is, the advance payment of the Non-Refundable Reservation.

At Smart Seven Stars we have designed a procedure that makes this process automatic and with the lowest possible control and operating cost:

Pre-Check-In

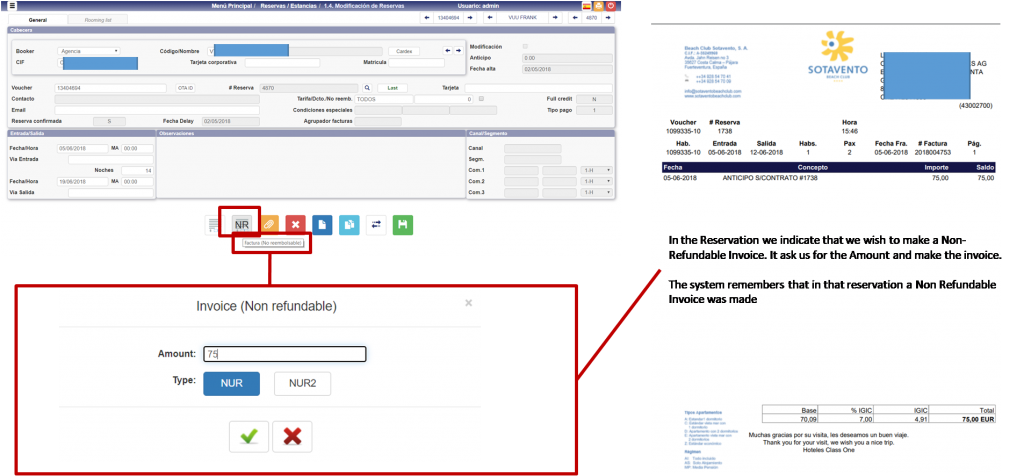

- From the Reservation itself you can make an invoice for the amount you consider appropriate (the total of the Reservation, the first 3 days, …), as defined in the conditions of the same.

- This invoice will be sent to the Client so that can be aware of this payment.

- It will be permanently registered in the reservation made.

- A Production of this charge will be made which will be canceled at the end of the stay.

Stay / Stay

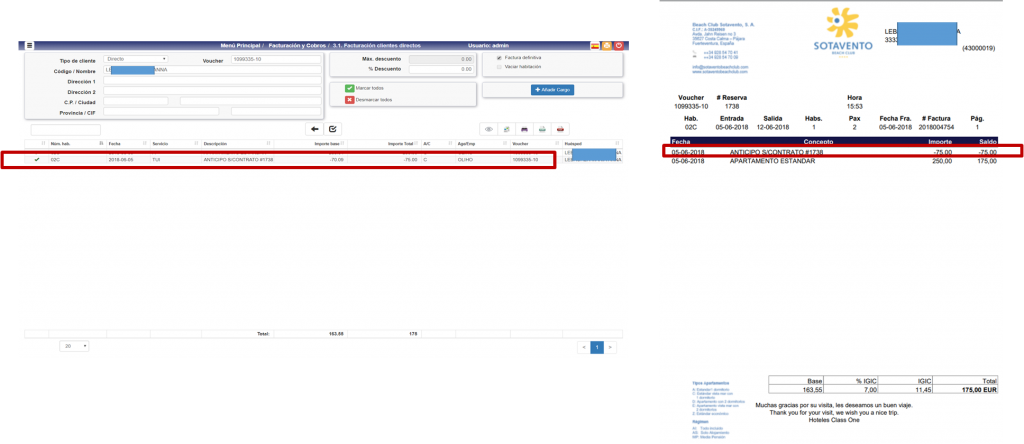

- The client will enter the hotel and the amount paid for the reservation will be kept at the Stay.

- The corresponding productions will be made on each day.

Check-Out

- At the time of “payment” for their stay, the amount already paid will automatically be charged, thus leaving the production of said concept at zero.

- An invoice could be issued at ZERO, if the amount paid in advance coincides with the amount payable at departure.

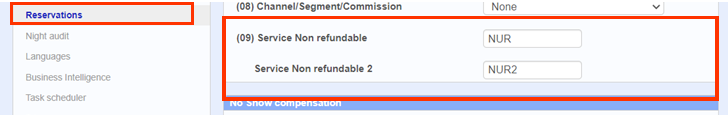

First of all, it is necessary to define the concept on which we want to apply the concept of non-refundable

As we can see, we can have up to two different concepts according to the accounting or production interpretation that we later want to give.

When we go to make the final invoice for said Reservation, that is, it has already become a stay, the system remembers that it had a Non-Refundable and negatively applies the amount charged

No Show

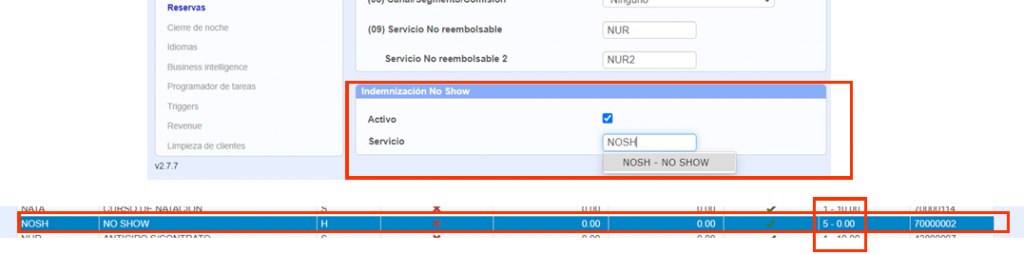

It could be the circumstance that the Client does not come to the Hotel, in that case, as it is a NON-Refundable, we have all the right to keep the previously made payment. Now, it would be necessary to produce the same correctly , in this respect the logical thing would be to make an invoice against a NO SHOW charge, which can be WITHOUT VAT (if it is considered compensation) or with VAT (consult with your advisors)

IMPORTANT

As long as the active box is checked under NO SHOW compensation :

- When a cancellation from an OTA ocurs and it was associated with a NON REFUNDABLE , the process automatically perfomes the NO SHOW invoice.

- When there is a manual cancellation of a Reservation that has a NON-REFUNDABLE associated, the process automatically produces the NO SHOW invoice.

Advances

There are many hotels that continue to do it the old-fashioned way and make the charge as if it were an Advance against the Reserve, regardless of what the legislation asks us to do, it is a process that continues to work equally well.